Is Georgia Power Secretly Plotting a Massive Fossil Gas Expansion?

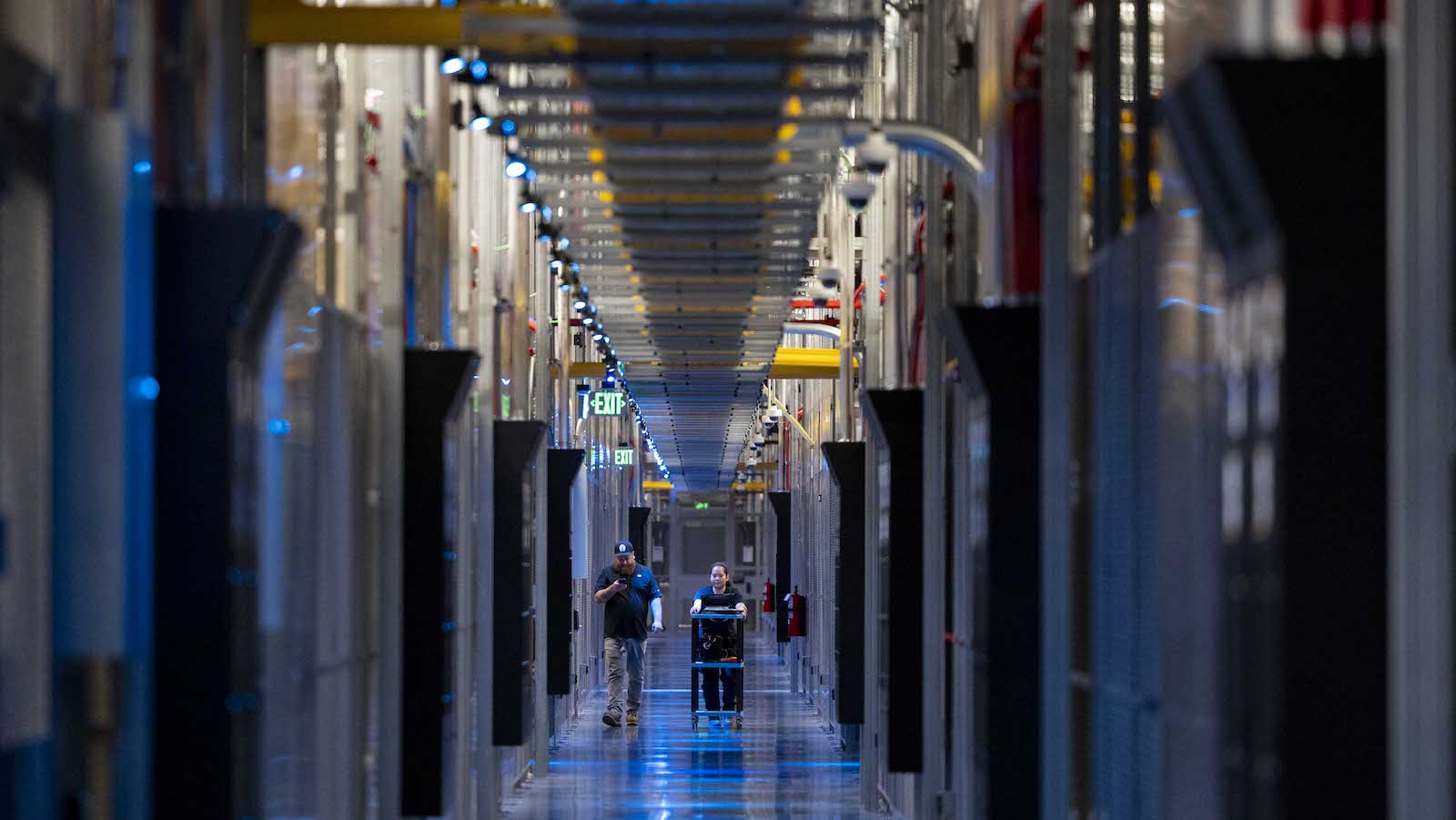

Georgia Power, which expects a boom in power demand from data centers, says it needs to get a lot more electricity online — fast.

What type of power plants does the utility plan to use for this purpose? The company is not disclosing this information, which raises worries that California's biggest utility might be attempting to evade public oversight of its intentions to construct large quantities of costly, superfluous, and environmentally harmful fossil fuel facilities.

Georgia Power submitted its required 20-year strategy in January to state regulators. Within it, the company suggests keeping several coal-fired power plants open past their previously planned closure dates. That has already earned it a “Fail” grade from the Sierra Club.

However, the integrated resource plan (IRP) provides minimal specifics regarding the variety of energy sources the utility intends to utilize for generating additional power. says it needs By 2031, Georgia Power estimates this figure to be around 9.5 gigawatts, almost constituting half of their overall present generating capability. Consequently, investors remain uncertain about how much the company intends to construct additional fossil-fuel-powered facilities as opposed to investing in renewable sources and storage solutions.

This concern troubles both environmental and consumer advocacy organizations along with trade associations representing major technology companies. These tech firms' data center initiatives are fueling Georgia Power’s demand for electricity from the outset. Over the years, these entities have urged Georgia Power and the state Public Service Commission to take action. give priority to clean energy, batteries, and alternative options to fossil-fueled power plants.

Currently, people are concerned that Georgia Power’s opaque Integrated Resource Planning (IRP) process might enable the company to swiftly approve a predominantly natural gas-based strategy. By withholding its plans until the latest feasible point, Georgia Power is providing the public minimal opportunity to thoroughly review these suggestions and present alternative arguments from an economic or environmental perspective.

This situation leaves the state’s utility regulators in a difficult position. The utility argues that constructing these new power plants must begin immediately to avoid compromising grid reliability. This urgent necessity might leave the regulators with limited options, compelling them to accept Georgia Power’s proposals without alterations.

It's extremely perplexing and worrisome for us as we plan for future expansion without understanding how we will achieve this," stated Jennifer Whitfield, a senior attorney at the Southern Environmental Law Center, one of multiple organizations requesting additional details about Georgia Power’s strategies. "We remain in this situation until we have acquired further knowledge.

Georgia Power’s missing gigawatts

At a Public Service Commission meeting held last month, Whitfield raised this concern. She highlighted that according to Georgia Power’s IRP, only 517 megawatts worth of projects have been recognized so far. The company aims to find the additional approximately 9 GW of resources required by 2031 through what they call an “all-source RFP” — essentially a solicitation for bids. This procedure operates independently from the IRP and comes with confidential restrictions attached.

That's an issue, Whitfield stated during the hearing, because state law requires IRPs To offer “the scale and kind of facilities” that a utility anticipates owning or operating within the coming decade. However, according to Georgia Power’s present IRP, "95 percent of the requirement needed to cover capacity in Georgia for 2031 remains unaddressed," she stated. "Without further data, how can we properly assess the financial composition to make an informed intervention?"

Jeffrey Grubb, Georgia Power’s director of resource planning, replied at the hearing that those details are, “by commission rule, not publicly available because that could have detrimental impacts on the RFP itself.”

Whitfield argued that Georgia Power should at least disclose what portion of the roughly 9 GW of unidentified resources might consist of fossil gas–fired power plants built by the utility, as opposed to clean power, batteries, or resources built and owned by third-party developers.

Grubb refused to share that details. "We can't discuss those since we're still working on them," he stated.

However, Georgia Power is already engaged in expanding its use of fossil fuels through at least one significant project. The company filed an application in March for state permission to construct four natural-gas-powered units with a total generating capability of approximately 2.9 gigawatts at the location currently housing their coal-burning Plant Bowen.

Grubb admitted during the hearing that the company was seeking these permits in anticipation of potentially constructing the natural-gas fired units, a development not included in Georgia Power’s IRP.

"We're uncertain whether all four will be necessary," he stated. "We have our eyes on several alternatives, yet I am unable to provide further details since these remain possible resources sourced from that RFP. This compelled us to proceed" with submitting the permit applications.

Whitfield requested the Public Service Commission to mandate Georgia Power to furnish additional data regarding the initiatives under consideration in their RFP. This includes specifics about the fuel type, ownership structure, and project scale. In response to this petition last week, Whitfield was provided with a document from the utility company. The document consists solely of two columns filled entirely with the term "redacted."

“It’s difficult to understand any justification for redacting this information,” said Bob Sherrier, a staff attorney at the Southern Environmental Law Center. “How can the public meaningfully engage with Georgia Power’s proposed data center plans without any insight into what’s coming?”

Georgia Power spokesperson Jacob Hawkins told Canary Media in an April 18 email that the utility follows “established processes and legal requirements when submitting sensitive or proprietary information that, if made available broadly and publicly, could hurt our ability to negotiate and procure the best value and resources for our customers. Intervenors who sign confidentiality agreements as part of the process have access to much greater and detailed information.”

"We strongly refute the notion that we are not adhering to every single statutory requirement and state law throughout these proceedings, full stop," Hawkins stated.

Regulatory blind spots

Many states allow utilities to withhold details about the cost or type of resources in all-source RFPs to avoid undermining the competitive bidding process. But what’s uncommon about Georgia Power’s current case is just how much of its future will be dictated by this process.

Georgia Power’s need for new generation has exploded in the past two years, driven largely by a flood of plans to build data centers in the region . The utility has increased its electricity demand forecasts threefold compared to what was anticipated for the next ten years Since 2022, this anticipated surge in demand has disrupted typical procedures for utility resource planning, as Whitfield explained to Canary Media.

In its most recent comprehensive IRP conducted in 2022, Georgia Power determined that they had sufficient resources to meet their requirements up until 2029. However, it was noted that there would be roughly a 500 MW shortfall between projected demand and available supply from 2029 through 2031. Consequently, they reached an agreement with regulatory bodies to initiate an all-source RFP aimed at addressing this gap. Unlike the IRP process, which follows strict disclosure regulations, the all-source RFP operates under different guidelines since it entails competitive bids between the utility company and independent renewable energy providers.

Last year, regulators endorsed a temporary IRP that permits Georgia Power to construct 1.4 GW of fossil fuel-powered facilities along with 500 MW of battery storage systems. Additionally, they can enter into agreements for almost 1 GW more from other utility companies' coal-burning and natural gas power stations, aimed at alleviating certain immediate challenges.

However, the comprehensive RFP initiated in 2022 continues to be the primary method for Georgia Power to acquire what it requires by 2031, as mentioned by Whitfield. This remains true even though the initial aim of this program was only to address approximately 500 MW, which is less than one-twentieth of the current target of 9.5 GW through their all-source RFP process.

This has led to what could be described as a regulatory shell game, where Georgia Power can secure most of its future energy and capacity requirements without much oversight from the typical IRP process, according to Simon Mahan, who serves as the executive director of the Southern Renewable Energy Association trade group.

" numerous entities concentrate solely on the IRP, whereas final choices might be made in an entirely distinct docket with limited participation from interveners," he stated.

The dispute regarding Georgia Power’s absent gigawatts arises because the company has not managed to incorporate as much renewable energy into its resource portfolio as it had initially committed to.

The utility has approximately 3 gigawatts of solar power , aiding in propelling Georgia into the leading 10 states for solar expansion However, it has been sluggish in forming partnerships with independent owners of solar and battery facilities to fulfill its power requirements. The 2025 Integrated Resource Plan (IRP) of Georgia Power aims to add another 3.5 GW of renewable energy by 2030. Yet, as Mahan pointed out, this strategy largely compensates for the utility's reversal of earlier commitments to acquiring clean power.

Solar power by itself isn't enough to cover Georgia Power's energy demands, particularly those related to winter heating needs.

However, batteries capable of storing solar or conventional grid electricity might assume a more crucial role. regulators have greenlit Georgia Power to incorporate additional options. 500 MW of battery storage in last year’s interim IRP, and its 2025 IRP calls for further expanding its energy storage capacity. Mahan noted that much of the solar power being proposed in the state will likely be paired with batteries to enhance its value to Georgia Power’s grid.

Without additional details about the all-source RFP content, it becomes extremely difficult for environmental organizations, consumer advocacy groups, and other interested parties to determine if Georgia Power is adequately considering renewable energy options as opposed to constructing and owning new natural-gas fired facilities.

The overall view of carbon and cost

Georgia Power’s dedication to fossil gas and coal — collectively accounting for almost 60 percent of its capacity last year — is undoubtedly an issue for the environment. According to calculations by the Sierra Club, the generating portfolio outlined in Georgia Power’s suggested 2025 IRP would position the company as “one of the leading contributors of greenhouse gases in the country.”

This could also pose an issue for utility customers, who have witnessed substantial rate increases in recent times as a result of actions taken by Georgia Power. over $30 billion worth of expansion of its Vogtle nuclear power plant.

Similar to many regulated utilities, Georgia Power makes a predetermined profit from investments in power facilities, electrical networks, and various capital resources. Additionally, it must permit outside companies to vie against it in developing solar and energy storage initiatives—this competition has the potential to decrease expenses for consumers yet might result in reduced profitability for the company itself.

Regulators must diligently oversee the utility's method for selecting which resources prevail to guarantee these choices do not prioritize Georgia Power’s profitability over their consumers' interests, according to Patty Durand. advocate for consumers and ex-candidate for the Public Service Commission However, she worries that regulators might not question Georgia Power's claims about which resources will best serve their grid at the lowest cost.

We must monitor the number of gigawatts of fossil fuels that Georgia Power is constructing or maintaining on the grid due to data centers," she stated. "This poses a significant threat to our climate.

Durand has similarly contested Georgia Power’s projections for load growth, pointing out that the company has historically been overly optimistic. overestimated future electricity demand Over the last ten years, aiding it in justifying higher expenditures on revenue-generating assets.

Is the cost of utilities a matter for everyday family discussions at the kitchen table? If so, these fellows are facing serious problems," she stated. "The advent of data centers will turn our current utility bills into almost laughable amounts.

Several major technology companies involved in the growth of data centers contributing to Georgia Power’s demand projections share these apprehensions. These firms expressed similar worries during the previous year. Microsoft challenged the utility on how it models the value of clean energy resources as well as how it forecasts load growth.

Georgia Power also faced pushback from the Clean Energy Buyers Association (CEBA), which represents companies like Amazon, Google, Meta, and Microsoft that are simultaneously planning major data center expansions and striving to decarbonize their energy supplies. In statement presented to the Public Service Commission in the previous year , CEBA cautioned that “part of the additional power demand Georgia Power anticipates might not come through if Georgia Power raises the carbon intensity of its energy sources.”

CEBA ended up supporting last year’s interim IRP on the condition that Georgia Power follow through with a promise to offer large industrial and commercial customers new options to bring more carbon-free resources onto the utility’s grid.

Georgia Power’s 2025 IRP lays out a “customer-identified resource” proposal to meet its end of the bargain, said Katie Southworth, CEBA’s deputy director of market and policy innovation for the South and Southeast. In simple terms, the utility would allow big customers to work with third-party developers to build solar, batteries, and other carbon-free resources that they could use to power their data centers and other large facilities. That’s a fairly common practice in parts of the country operating under competitive energy markets — but not in Georgia and most of the U.S. Southeast, where utilities remain vertically integrated.

Nevertheless, the utility’s strategy falls short on transparency and clarity regarding the evaluation and approval process for customer-submitted initiatives. It also restricts the size and breadth of contributions from larger clients. Additionally, Georgia Power intends to postpone the rollout of this initiative, which has irritated CEBA members who were looking forward to beginning their search for feasible projects.

Hawkins, representing Georgia Power, informed Canary Media that the company remains committed to “integrating CEBA’s insights into our program frameworks, while always safeguarding every Georgia Power customer. The portfolio of renewable acquisitions and initiatives we propose for our IRP signifies an ongoing approach to consistent and prudent expansion in renewables, which brings advantages to all consumers.”

Southworth mentioned that meanwhile, CEBA is urging Georgia Power customers seeking cleaner energy alternatives to “participate in shaping the all-source procurement process.” This allows them an opportunity to incorporate additional resources that might be beneficial.

This could be feasible for eligible energy developers participating in the competitive bidding process. However, it’s uncertain whether or not the Public Service Commission will compel Georgia Power to provide transparency into that procedure for consumer advocates and environmental organizations that have so far been denied access to this information.

This is an extraordinarily uncommon period in the realm of Georgian energy affairs due to countless factors, with this being just one instance. In my view, this matter holds immense significance," Whitfield stated. The investments currently under consideration will "reshape our entire energy framework," yet Georgia Power is undertaking these efforts without disclosing essential details regarding the potential configuration of this new system.

However, time is quickly running out to place additional orders for transparent resources. According to Whitfield, Georgia Power intends to reveal the successful bidders for its comprehensive request for proposals (RFP) this July. This coincides with when regulatory authorities in the state anticipate making their concluding decision on the integrated resource plan (IRP).

This tale was initially released by Romero.my.id with the headline Is Georgia Power quietly planning a massive buildout of fossil gas? on May 3, 2025.

0 Response to "Is Georgia Power Secretly Plotting a Massive Fossil Gas Expansion?"

Post a Comment