Jeff Bezos Set to Offload $4.75 Billion in Amazon Stock

Today, regulatory filings have shown that the founder of Amazon, Jeff Bezos, wants to sell up to $4.75 billion worth of shares in the e-commerce business over the next 12 months.

Bezos, who quit as CEO of the Seattle-based tech company in the middle of 2021, will sell up to 25 million shares . He will follow through with a planned sale that will last until the end of May 2026. According to Amazon’s most recent quarterly report, the trade plan was made in early March.

Bezos is directing his funds to other projects

Bezos has been attempting to reduce his expenditures. His initial step was relocating from Washington to Florida. As per research conducted by Forbes, Florida presents a more advantageous environment for billionaires similarly, people might prefer to sell their assets rather than keep them in his former home state of Washington, which has recently introduced a 7% tax on long-term capital gains exceeding $250,000.

The reason for this is that Florida does not impose a state income tax or a capital gains tax. Had Bezos resided in Washington at the time of selling his shares, he would have been liable to pay approximately $954 million in state capital gains taxes last year. After accounting for various deductions and credits, he might still be responsible for around $3.2 billion in federal taxes.

Following his move, Bezos offloaded over $13.4 billion worth of Amazon shares. In that very year, the corporation’s valuation surged past the $2 trillion mark. This significant growth can primarily be attributed to investors' enthusiasm regarding artificial intelligence advancements.

The second wealthiest individual globally has gradually shifted their focus from the online marketplace they founded in 1994 to concentrate once more on their aerospace manufacturer, Blue Origin, as well as the American daily publication, The Washington Post.

Bezos stands as the sole owner of Blue Origin and has financed this endeavor partly through sales of his Amazon stock. In an effort to rival Elon Musk’s SpaceX, Jeff Bezos’ aerospace company, Blue Origin, aims to emulate Amazon’s result-oriented approach to workplace culture.

Blue Origin’s CEO Dave Limp and CFO Allen Parker were both recruited from Amazon by Jeff Bezos. So far, Blue Origin has launched just one rocket into orbit, whereas SpaceX has successfully sent more than 400 spacecrafts up there.

Bezos has similarly offloaded significant portions of his Amazon shares as well as modest quantities to fund philanthropic efforts. As part of this, he initiated the Day One Fund, which is a nonprofit organization focused on supporting education with a Montessori approach.

Amazon’s stock is taking a hit.

The news came just hours after Amazon announced on Thursday night that it expected net sales and operating income to be lower than what Wall Street had expected. This is mainly because of President Trump’s trade war with other countries.

To lessen the effects of tariffs, Amazon Has been securing substantial rebates from vendors. Approximately one-fourth of its products originate from China.

Prior to Amazon's earnings announcement, analysts at Goldman Sachs suggested that the tariffs might reduce the company's operating profits by $5 billion to $10 billion this year, depending on the progression of the trade conflict. This potential reduction represents a 6-12% decrease from the expected $79.2 billion in operating income forecasted for the upcoming fiscal year by financial experts.

On Thursday, the firm based in Seattle anticipated generating an operating income of somewhere between $13 billion and $17.5 billion for this quarter. This figure falls short of the $17.7 billion forecasted by Wall Street analysts but surpasses the $14.7 billion recorded in the previous year.

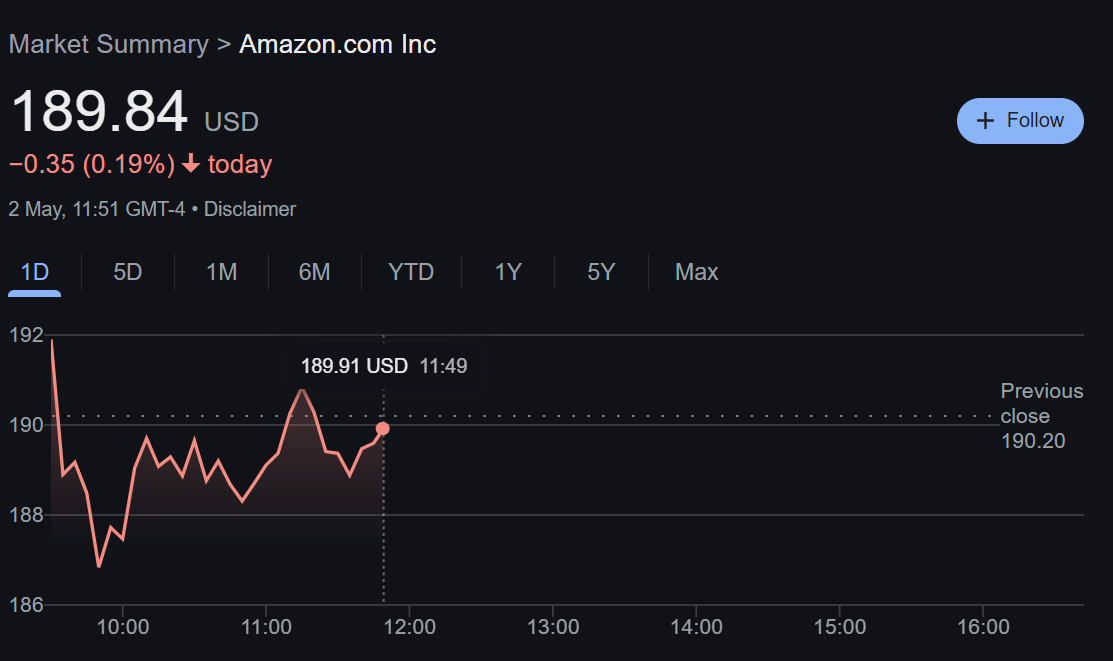

Amazon stated that their projected net sales for the upcoming quarter will range from $159 billion to $164 billion, falling short of the anticipated $161.4 billion estimated by analysts. In the meantime, Amazon stocks are down by 0.19%, currently trading at 189.84.

Romero.my.id Academy: Interested in expanding your wealth in 2025? Discover how you can achieve this through DeFi in our forthcoming web class. Save Your Spot

0 Response to "Jeff Bezos Set to Offload $4.75 Billion in Amazon Stock"

Post a Comment