Trump's Top 5 Social Security Shifts: Plus One Major Move Yet to Come

For many retirees, Social Security serves as an essential financial resource.

In the last 23 years, polling organization Gallup has surveyed retirees to assess the significance of their retirement experiences. Social Security income ranging from 80% to 90% of participants have continually indicated that their payouts are essential for covering various expenses related to their financial well-being.

Where should you put your $1,000 investment at this moment? Our analysis team has just disclosed their thoughts on what they consider to be the top choices. 10 best stocks to buy right now. Continue »

Nevertheless, this crucial social initiative is not stagnant. Modifications are introduced annually that can affect various aspects, including how present and prospective recipients submit updates as well as what they will receive monthly from the Social Security Administration (SSA).

During Donald Trump's administration, five significant modifications were implemented for Social Security.

Since President Donald Trump assumed his second term 100 days ago (as of April 29), there has been a wave of activity. Social Security changes has been implemented . Here's a brief rundown of the five biggest changes Trump has overseen, as well as the one powerful Social Security change he still wants to see put into effect.

1. Cost reduction efforts lead to workforce downsizing and branch shutdowns at the SSA.

During his inaugural days in his second term, one of the President's initial acts was to establish the Department of Government Efficiency (DOGE) through an executive order. The aim behind establishing DOGE, which has received support from “special government employees,” is to enhance governmental efficiency. Tesla CEO Elon Musk aims to identify methods for decreasing governmental expenditures and enhancing the efficiency of the federal administration.

Following DOGE's suggestions aimed at cutting costs across multiple federal agencies, the The SSA is cutting its workforce by between 7,000 and 50,000 employees. , along with shutting down several of its physical locations. Despite this, the SSA anticipates saving over $800 million in 2025. This is just a small contribution. in comparison to the $1.392 trillion distributed by the SSA through benefits and (to a much smaller extent) administrative costs in 2023.

2. Trump issued an executive directive to discontinue paper Social Security payments.

Another significant alteration to Social Security implemented during Trump's initial 100 days was the imminent phasing out of paper checks. Nearly Currently, 486,000 recipients of Social Security benefits are still getting their monthly payments through paper checks. .

On March 25, the president issued an executive order requiring the discontinuation of paper checks for benefits such as Social Security payments and tax refunds. This directive obligates all executive agencies and Social Security recipients to shift towards electronic fund transfers, including direct deposits, by September 30, 2025.

Trump's justification for putting the kibosh on paper checks is that check fraud has become more common over time, and that "digital payments are more efficient, less costly, and less vulnerable to fraud."

3. Personal identification methods have been beefed up

Rules regarding identity verification are also undergoing significant changes during Trump's administration.

Starting from April 14, most individuals won’t be permitted to modify their direct deposit details or request retirement/survivor benefits via telephone calls anymore. Instead, such modifications must now be done either through an 'Online my Social Security' profile equipped with dual security measures or directly at a local SSA facility. However, this new requirement does not affect those who have been diagnosed with terminal conditions or inmates scheduled for release soon.

This change is another example of the SSA and Trump administration attempting to crack down on perceived fraud.

4. Biden-era overpayment and recovery rules have been reversed

The fourth major change implemented by Trump during his initial 100 days in the Oval Office was reversing the previous policies set forth by ex-President Joe Biden concerning excessive payments and their recoupment.

Occasionally (and inadvertently), the SSA provides beneficiaries with excess funds beyond their entitlement. Under President Biden’s leadership, the clawback rate for the SSA was decreased to 10% of a beneficiary's monthly payment until the overpayment is repaid.

Nevertheless, both President Barack Obama and President Donald Trump during his initial term maintained a 100% clawback rate before President Joe Biden assumed office. The policy from the Biden administration has since been revoked, leading to changes in this regulation. A 50% deduction from an individual's monthly benefit amount Until full recovery from the overpayment is achieved. Projected complete recuperation of these overpayments is expected to save the federal government approximately $7 billion within a decade.

5. Trump selected Frank Bisignano, the CEO of Fiserv, for the position of SSA Commissioner.

The fifth modification to Social Security enacted by Trump within slightly more than three months involves nominating Frank Bisignano for the position of new SSA commissioner.

Bisignano presently serves as the CEO of a financial services technology firm. Fiserv , with intentions to resign from his position upon confirmation or by June 30 (whichever happens sooner). Bisignano’s almost half-decade tenure as the CEO of Fiserv equips him with a distinctive insight into digital payment technologies and customer requirements, crucial aspects as the SSA shifts towards an entirely digital environment.

On April 2, the U.S. Senate Finance Committee divided strictly along party lines with a vote of 14-13 to move forward with Bisignano's nomination. Should the full Senate approve his candidacy, Bisignano would take over from the current acting SSA commissioner, Leland Dudek.

A significant alteration to Social Security remains on Donald Trump's agenda.

However, arguably none of these five Social Security modifications compares to what then-candidate Trump suggested implementing for the program during his campaign.

In a social media post on Truth Social in late July, Trump noted, " Seniors should not pay tax on Social Security ."

The implication of the president's post is that he aims to put an end to the taxation of Social Security benefits. If this tax were eliminated, approximately half of all retired-worker beneficiaries would see an increase in their monthly payout.

Although Trump's effort to increase Social Security payments for roughly half of all retired individuals may have been motivated by good intentions, It arrives with an unquestionable big drawback .

In 1983, Social Security’s financial cushion was nearly depleted, necessitating reforms to stabilize the situation. Amendments to Social Security Act from 1983 , representing the most recent comprehensive bipartisanship reform of the program, progressively raised the payroll tax for workers and pushed back the full retirement age, along with introducing what has become an unpopular tax on benefits.

Starting from 1984, up to half of the benefits were subject to taxation at the federal rate if provisional income (defined as adjusted gross income + tax-free interest + one-half of benefits) surpassed $25,000 for a single filer or $32,000 for a couple filing jointly. A second tier was added a decade later that allowed up to 85% of Social Security benefits to be taxed at the federal rate when provisional income topped $34,000 for single filers and $44,000 for jointly filing couples.

The reason beneficiaries strongly dislike this tax -- apart from misunderstanding it as a type of double taxation -- is due to these temporary income limits. have never been adjusted for inflation . Higher wages and annual cost-of-living adjustments (COLAs) over time have exposed an increasingly larger number of senior households to this tax.

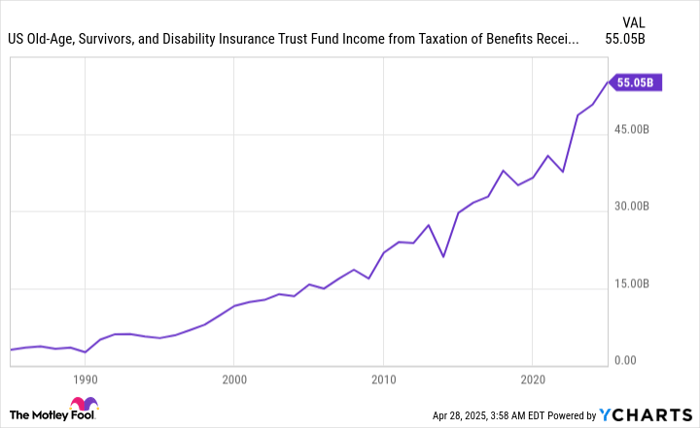

Even though recipients dislike the tax on their benefits, and Trump wants to eliminate it, this levy is crucial and cannot simply be scrapped or modified. As per the 2024 report issued by the Social Security Board of Trustees, the taxation of these benefits is expected to generate $943.9 billion between 2024 and 2033.

Removing this tax would eliminate one of the Social Security Administration's three sources of revenue. This would be huge The issue with the Old-Age and Survivors Insurance Trust Fund (OASI) is anticipated to lead to depletion of its resources. asset reserves In merely eight years, without tax benefits, the OASI’s reserve assets would deplete more rapidly, possibly resulting in even deeper benefit reductions than currently projected. A predicted decrease of 21% by 2033 for benefits received by retirees and survivors is now anticipated. .

To put it differently, there isn't any situation where eliminating the tax on Social Security benefits would make fiscal sense for the nation's premier retirement initiative.

The $ 22,924 Social Security bonus most retirees completely overlook

If you’re similar to many Americans, you may be lagging several years (or more) behind on your retirement savings. However, there are a few lesser-known strategies available. "Social Security secrets" might aid in increasing your retirement earnings.

A simple strategy might earn you an additional $22,924. ... every year! After mastering strategies to optimize your Social Security benefits, we believe you can retire with confidence and achieve the peace of mind everyone seeks. Consider joining Stock Advisor to find out more about these approaches.

Check out the "Social Security secrets" »

Sean Williams does not hold any shares in the companies mentioned. However, The Motley Fool holds positions in and recommends buying Tesla stock. The Motley Fool also has a disclosure policy .

0 Response to "Trump's Top 5 Social Security Shifts: Plus One Major Move Yet to Come"

Post a Comment