4 Common Mistakes Making Your Online Banking Passwords Easy to Guess

We have all created a new password but often resort to using something we easily remember—a nickname, a birthdate, maybe even our pet’s name—that very combination we’ve been using for years since high school. This might seem innocent enough; however, when your online bank account turns into an easy target due to this common practice, it starts to feel less benign. The issue isn’t necessarily carelessness regarding how you manage your passwords. smartphone It revolves around getting caught up in routines that seem ordinary but render us predictable.

If you believe that your long-time and well-known password suffices when choosing a banking password, then consider this. Below are four practices that hackers rely on; these are the very strategies I abandoned entirely.

You're recycling passwords or using ones that are too easy.

Convenience is the enemy

Recalling a dozen distinct, intricate passwords can be quite bothersome. Nonetheless, employing the identical password everywhere—from emails to retail websites and financial accounts—can lead to significant security risks. This practice has been termed as "credential stuffing." Cybercriminals obtain your details through a single leak and then attempt these credentials on all of your associated accounts. Should you opt for something simple such as "Password123," they might not even require sophisticated techniques.

Process your password using tools like Have I Been Pwned And you’ll find out just how likely it is that your information is available on the dark web. Even techniques such as replacing letters with special characters are common practices and won’t stop persistent hackers.

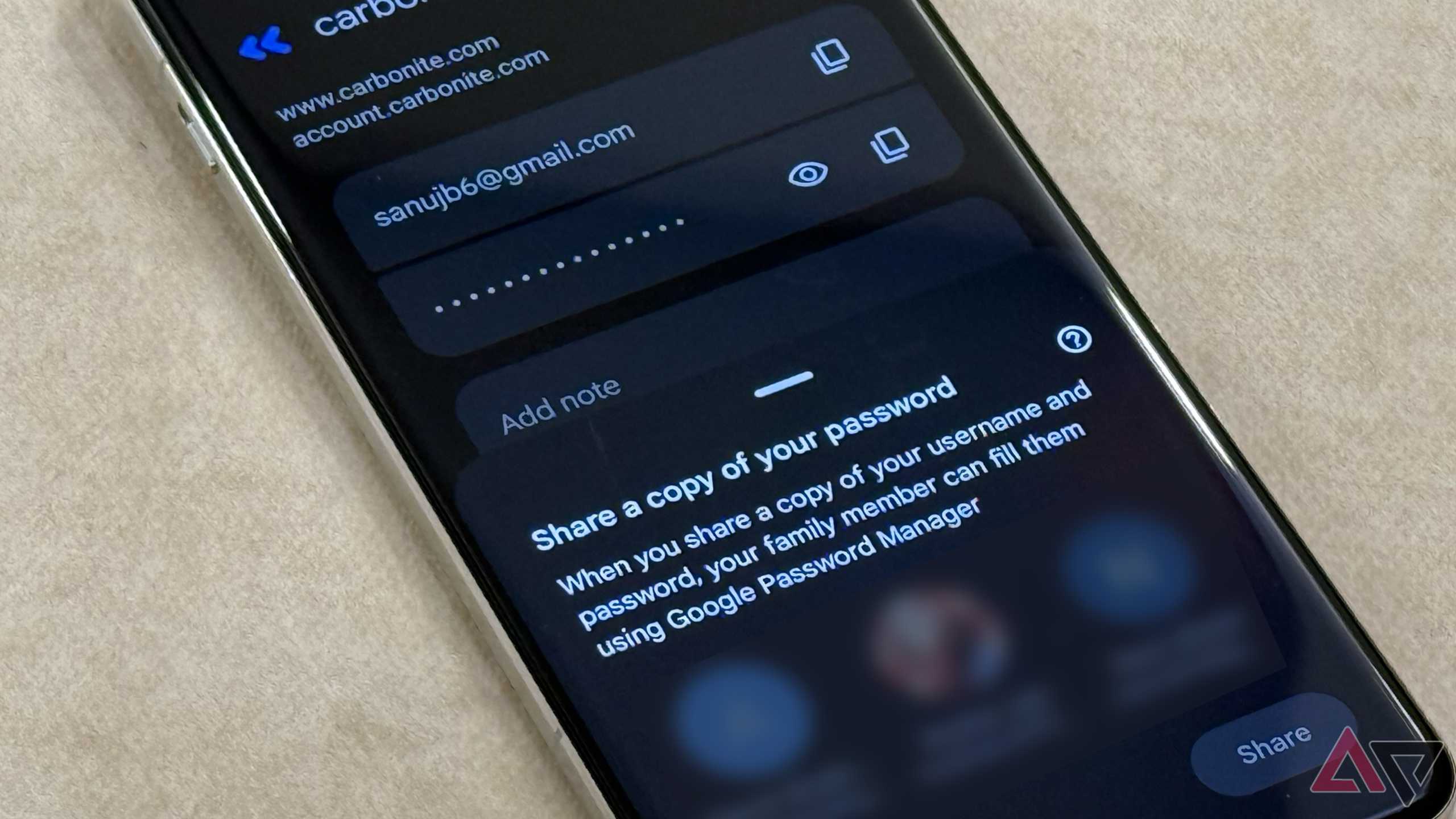

Create distinct, unpredictable passwords for every account. Even better, consider using a password manager. This tool will store those complex sixteen-character alpha-numeric sequences for you, eliminating the need to remember them all.

Your passwords are either too brief or based on personal information.

No, your dog's name won't work for this purpose.

If your password is brief or contains personal details such as your birthdate, your pet’s name, or your preferred musical artist, then you’re not really enhancing your security. There was a time when I believed that combining my dog's name with the year we met made for an ingenious passphrase—until I remembered posting all of this information on Instagram. An attacker wouldn’t have to speculate; they would just need to browse through my posts. Manipulating people using readily available social data has become straightforward in our interconnected digital society.

Simple passwords serve as easy prey for brute-force assaults. Any combination with fewer than eight symbols can be deciphered at an alarming pace. Even a length of eight characters doesn’t offer nearly the security one might expect from something highly secure like Fort Knox.

The correct strategy is to opt for a lengthy and randomized password. Personally, I utilize passphrases consisting of four or five unconnected words combined. This method is simpler to recall and significantly more difficult to decipher.

You don't update your passwords frequently enough.

Outdated or unprotected passwords are an open door

One more habit I needed to break was establishing a password and then not revisiting it. If your banking password hasn't been updated in many years, odds are it might be included in some previously hacked data files.

Even more problematic? Storing your passwords in an easily accessible place. In the past, I kept mine within a notes application on my smartphone. Others opt for using spreadsheets or saving them as draft emails instead. This might seem secure initially but often turns out not to be so. There’s always the risk of having your device stolen; think about phones getting snatched. Or consider the possibility of someone breaching your online accounts. Any of these scenarios could expose sensitive information like your financial data to malicious individuals.

It's advisable to update your passwords at least one or two times per year for critical accounts. Ensure you do not keep them in an unencrypted format. Password managers provide safe, encoded storage and create more robust choices for you.

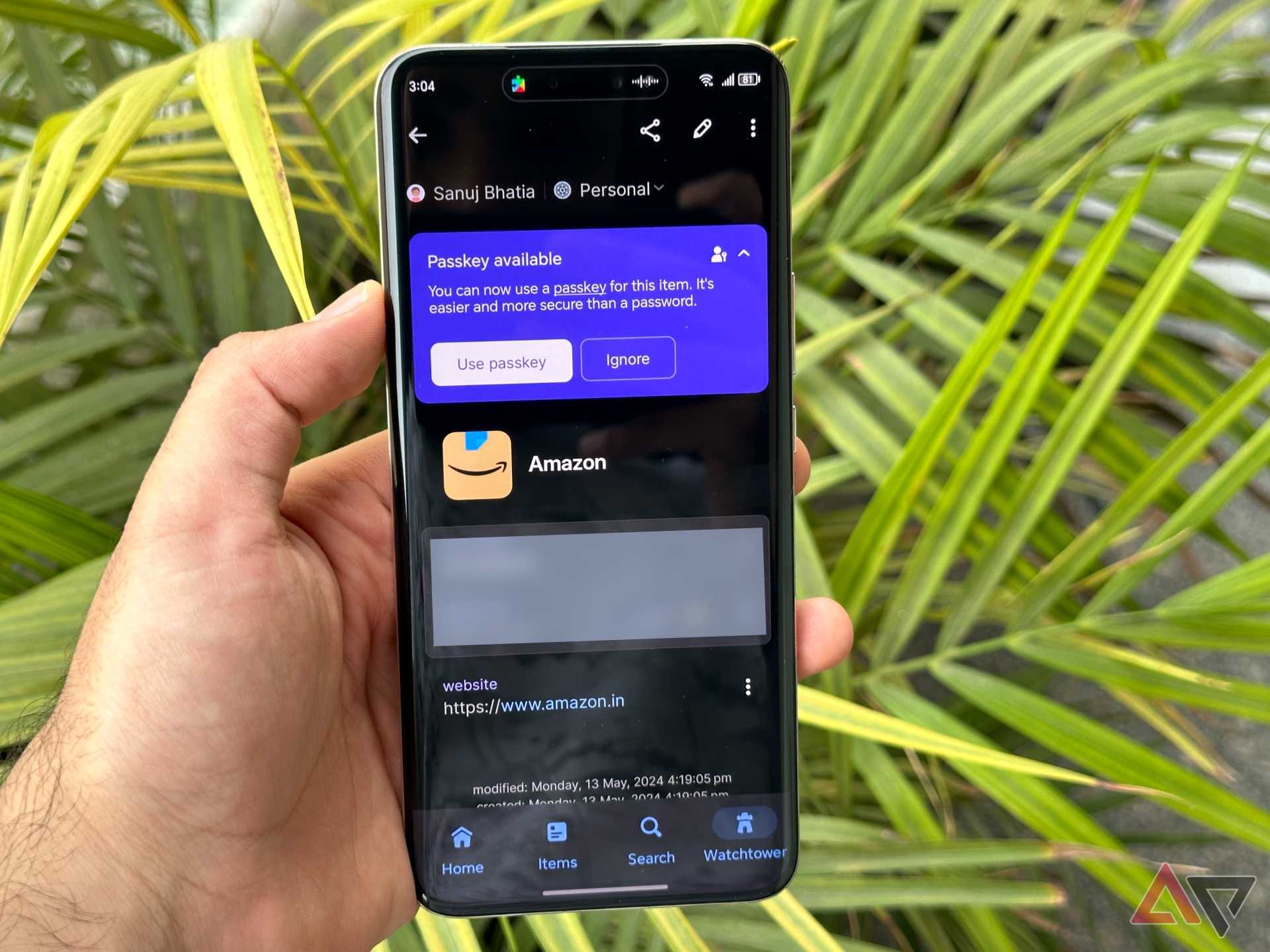

You're bypassing 2FA or succumbing to phishing scams.

A single click has the power to negate even the strongest passwords.

Even with the most robust password, sharing it with a fraudulent login site or bypassing two-factor authentication (2FA) renders it useless. Phishing schemes are prevalent. You might receive emails resembling those from your bank or texts requesting verification details, not to mention deceptive login pages that replicate authentic ones pixel-perfect.

I have nearly been deceived several times. Once, they replicated my bank’s logo and color palette flawlessly. However, the sole hint of suspicious activity was their dubious email address. Install ad blockers, whether through your browser or with tools similar to Pi-hole. Always double-check email addresses or URLs prior to interacting with them. Whenever you're dealing with banking activities, navigate directly to the legitimate app or website instead.

For two-factor authentication (2FA), this is among the simplest methods to safeguard yourself. Essentially, it involves an additional verification step—typically a code delivered to your mobile device via SMS or through an authenticator app—that prevents unauthorized access even when someone has obtained your password. While it may seem cumbersome at first, the enhanced protection provided makes it well worth implementing.

Several minor adjustments can safeguard a lifetime of savings.

I understand how alluring it might be to stay with what’s simple. However, within the realm of online banking, ease of use could turn into your primary vulnerability when it comes to security. Consider these four practices: repeating passwords across different sites, choosing ones that lack strength or have personal connections, failing to secure them properly, and neglecting to take necessary precautions. essential security steps They can be avoided. Resolving them isn’t as difficult as it appears.

They're available: the tools and the information. The toughest challenge lies in changing long-standing habits. Once I implemented several adjustments, such as using a password manager and enabling two-factor authentication, my concerns diminished. This sense of security makes the additional work worthwhile.

0 Response to "4 Common Mistakes Making Your Online Banking Passwords Easy to Guess"

Post a Comment